-

On this page

Financial hardship information is a sign next to a repayment on an individual’s repayment history in their credit report to show that they have either a temporary or permanent financial hardship arrangement with a credit provider.

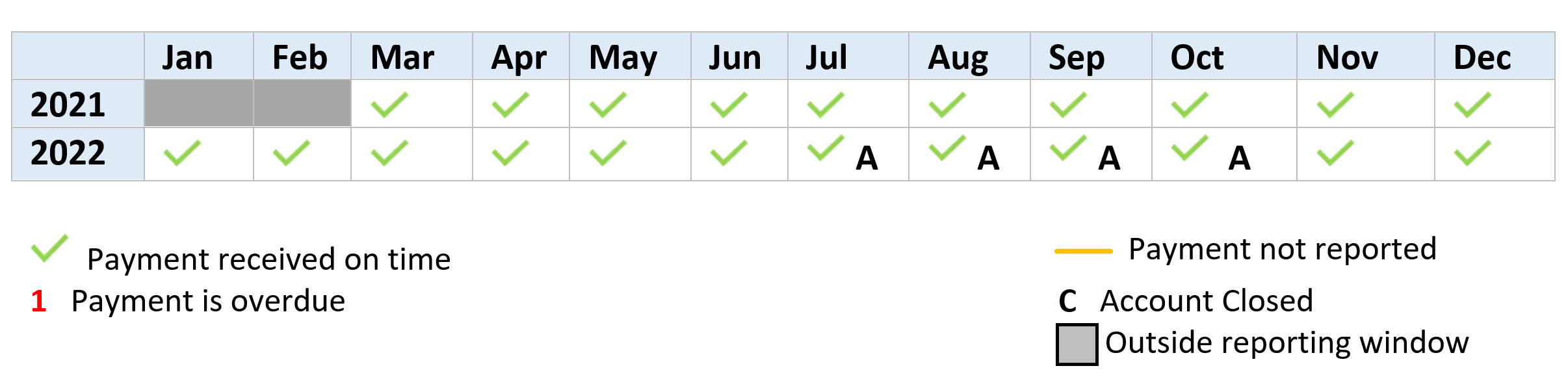

The sign for a temporary financial hardship arrangement is ‘A’. It appears against each repayment during the arrangement. One year after the arrangement’s final repayment all signs showing the arrangement are removed. So, if an individual had a temporary financial arrangement with a credit provider from July 2022 to October 2022, from October 2023 their credit report no longer shows ‘A’ against any repayment.

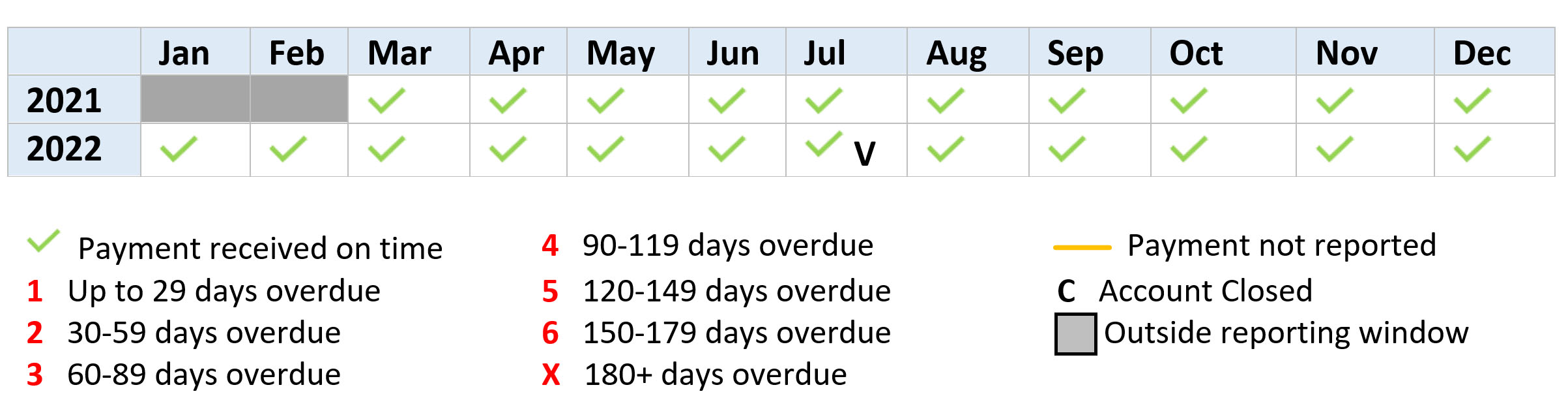

‘V’ is the sign for a permanent financial hardship arrangement (known as a variation financial hardship arrangement). It appears against the repayment when the arrangement started. One year after the arrangement started the sign is removed. So, if an individual had a variation financial hardship arrangement with a credit provider from July 2022, from July 2023 their credit report no longer shows ‘V’ against the first repayment under the new arrangements.

A credit report doesn’t show the reason for a financial hardship arrangement. A credit report’s repayment history only shows if a repayment was:

- received on time (shown as a tick (

) or a zero ‘0’)

) or a zero ‘0’) - overdue (shown as ‘1’)

- part of a temporary (‘A’) or variation financial hardship arrangement (‘V’).

A temporary financial hardship arrangement on a credit report is shown below.

A variation financial hardship arrangement on a credit report is shown below.

A credit reporting body can’t use financial hardship information to calculate an individual’s credit score.

Why is financial hardship information shown on a credit report?

Financial hardship information reflects your current repayment obligations with a credit provider. It gives other credit providers a more complete picture of your repayment obligations without intruding into the reason for the financial hardship arrangement. They can see you’re experiencing hardship and may decide to extend credit to help you meet your repayment obligations. If they want to know the reason for arrangement, they must contact you and then it’s your call if you tell them.

From 1 July 2022, under the Privacy Act 1988, a credit provider must tell a credit reporting body that they have financial hardship arrangement with an individual and the type of arrangement, temporary or permanent. And the credit reporting body must show this arrangement on the individual’s credit report.

Before 1 July 2022, an individual could have a financial hardship agreement with their credit provider but there was no way to show this arrangement on their credit report.

If you have a complaint

If you have a complaint about how your financial hardship arrangement is shown on your credit report, or about your credit provider or the credit reporting body, contact your credit provider or the credit reporting body to see if they can resolve the issue for you.

If you think the personal information your credit provider or the credit reporting body holds about you is not correct, contact them and request they correct it.

If you’re not happy with your credit provider or the credit reporting body’s response, contact their external dispute resolution scheme (for example, the Australian Financial Complaints Authority. Or you can make a complaint to us.